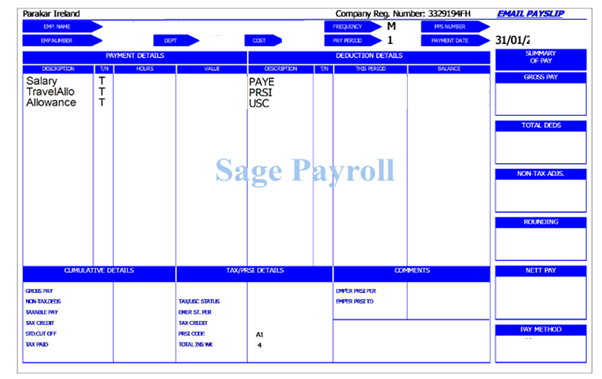

Payslips in Ireland: How does it work?

Payslips are essential documents that provide a detailed breakdown of your earnings and deductions, ensuring transparency and compliance with legal regulations. If you’re working in Ireland, understanding your payslip is crucial for managing your finances effectively. In this blog post, we’ll break down the key components of a typical Irish payslip.

1. Personal Information

At the top of your Irish payslip, you’ll find personal details:

- EMP NAME: This section displays the employee’s name.

- EMP NUMBER: This is the unique employee identification number.

- DEPT: This is a code indicating the partner or department.

- COST: This code represents the client or cost center.

- FREQUENCY > M: Indicates that the employee is paid on a monthly basis.

- PAY PERIOD > 1: Specifies the pay period number, e.g., January is 1, February is 2, and so on.

- PPS NUMBER: This is the employee’s Personal Public Service number, linked to the revenue system for tax allocation.

- PAYMENT DATE: Always indicates the last day of the month.

- Company Reg. Number: This is the registration number of the company (e.g., 3329194FH).

2. Payment and deduction details

The middle part of the payslip provides a breakdown of all payments and deductions for the employee. While specific details vary for each individual, certain elements are common to all employees:

- Salary: Listed under payment details.

- PAYE, PRSI, and USC: These are tax deductions listed under deduction details.

- Summary of Pay: On the right, this section provides a further breakdown of totals, ultimately leading to the total Nett pay, which is found at the bottom right of the payslip.

Payment details are the gross amount and deduction details show all taxes or deductions.

3. Cumulative details

At the bottom of the payslip, you’ll find cumulative details summarizing all payments and deductions for the employee throughout the tax year. This section also includes information about the employee’s tax code. Additionally, it outlines the total amount of PRSI ( employer social security) per month and total per year, that the employer has paid for the tax year.

Please keep in mind that all specific figures, names, numbers, and amounts have been blocked out in the provided sample payslip for privacy and security reasons. It’s important to note that Parakar, or any employer, has no control over an employee’s tax amounts or codes, as this is managed by the Irish Revenue Service.

For specific questions regarding your payslip, feel free to reach out to our HR expert.