German Tax Classes Explained

Understanding the Tax Classes in Germany: A Complete Guide

If you’re working in Germany, your tax class (Steuerklasse) determines how much income tax is deducted from your monthly salary. Choosing the right tax category Germany can have a big impact on your take-home pay, your household income, and even the tax refund you might get at the end of the year.

The German tax system is designed to reflect different marital statuses, income levels, and family situations. With different tax classes in Germany, it’s important to understand how they work and which one applies to you. In this guide, we’ll answer the common question “what are the tax classes in Germany?”, break down each option, and explain when switching might be beneficial.

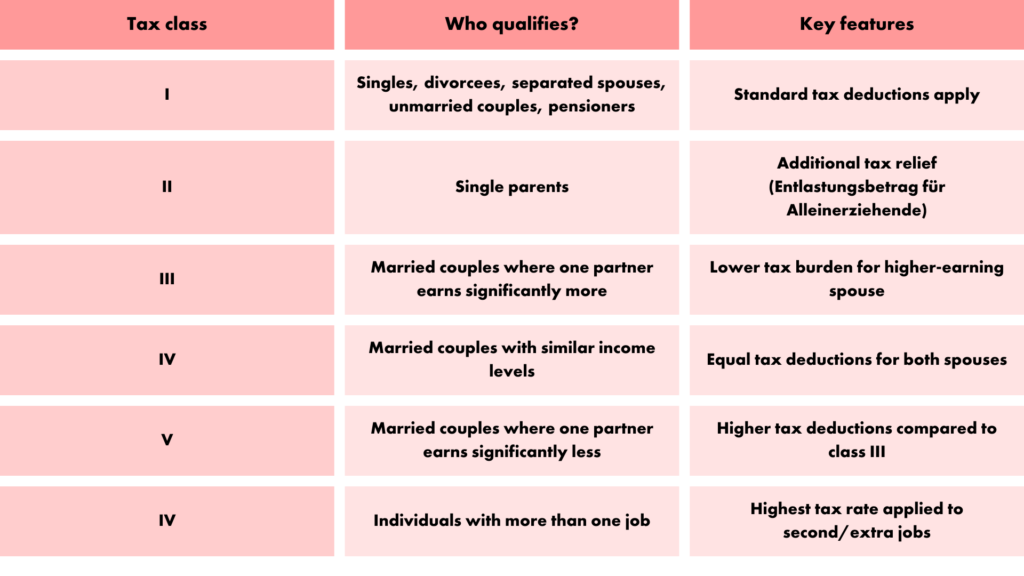

Overview of Tax Classes in Germany

There are six income tax class Germany categories. Each one reflects your personal and family situation, which directly affects the amount of income tax (Lohnsteuer), solidarity surcharge, and church tax deducted from your salary.

Tax Class I (Steuerklasse I): Singles and unmarried employees

This tax class for single in Germany applies if you’re single, divorced, widowed (after the first year), or permanently separated. Pensioners without a spouse also belong here. It follows the standard tax rate and only includes the basic tax-free allowance (Grundfreibetrag).

Tax Class II (Steuerklasse II): Single parents

For single parents living with at least one child, this class provides additional tax relief (Entlastungsbetrag für Alleinerziehende) to lower the overall tax burden.

Tax Class III (Steuerklasse III): Higher-earning spouse in a marriage or partnership

This is part of the tax class for married couples Germany. The higher-earning partner is placed in Class III, while the lower-earning partner goes into Class V. It usually results in higher net income for the household when one partner earns significantly more.

Tax Class IV (Steuerklasse IV): Married couples with similar incomes

This class applies when both partners earn roughly the same. It ensures equal deductions, avoiding the heavier tax load that comes with Class V.

Tax Class V (Steuerklasse V): Lower-earning spouse in a marriage or partnership

The lower-earning spouse is placed here as part of the III/V combination. While deductions are higher for this partner, the household benefits overall if one partner earns much more.

Tax Class VI (Steuerklasse VI): Employees with multiple jobs

For second or additional jobs, Class VI applies. No basic allowance is granted, so deductions are higher compared to your main job.

Changing Your Tax Class in Germany

Employees are not permanently tied to one class. Depending on your situation, you can switch once per year or after certain life events such as marriage, divorce, separation, or a change in income.

Examples of when switching helps:

- After marriage, moving from IV/IV to III/V can increase household net income.

- If incomes become more equal, couples may switch back to IV/IV.

- During parental leave or unemployment, switching to III/V reduces the burden on the working partner.

Applications for a change are made through your local Finanzamt using the official form (“Antrag auf Steuerklassenwechsel bei Ehegatten/Lebenspartnern”).

Choosing the Right Tax Class

Picking the right tax category in Germany is key to optimizing your income and tax outcome. Whether you’re single, married, or working multiple jobs, your tax class directly affects both your monthly salary and your annual return.

At Parakar, we guide individuals and companies through Germany’s payroll and tax regulations. If you’re unsure which tax class suits your situation, our experts can help you make the best decision for your financial future.

Get in touch with our team to ensure you’re maximizing your income while staying compliant with German tax rules.

Get in touch!