Payroll and Social Security Updates in Germany for 2025

As we prepare for 2025, significant updates to payroll, social security premiums, and tax regulations in Germany are set to take effect. At Parakar, we are committed to ensuring that your payroll systems are fully updated and compliant with these changes. Below, we’ve outlined the key updates to help you stay informed about what to expect in the coming year.

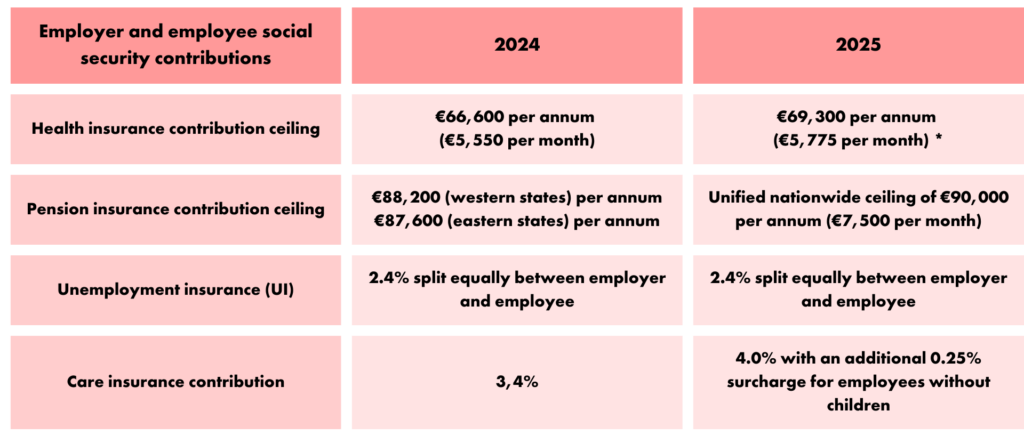

Employer and employee social security contributions

The contribution rates and thresholds for social security in 2025 are as follows:

* Employees earning above this limit may be automatically moved to statutory insurance, which could impact net salaries.

Income tax adjustments

Basic personal allowance (Grundfreibetrag):

- 2024: €11,604

- 2025: €12,096

Cold progression adjustments: Tax brackets have been updated to offset inflation, benefiting low- and middle-income earners.

Digital sick notes

From 2025 Sick notes from foreign and private doctors will still be sent digitally to employers, but these notes will not specify the time period for which they are valid. For all other cases, digital sick notes will continue to specify the valid time period.

Paid child leave sick days

In 2025, parents can take up to 15 fully paid sick days per child per parent to care for a sick child. Single parents are entitled to 30 paid sick days per child.

Tax free inflation bonus

While the option to pay a tax-free inflation bonus of up to €3,000 was available until December 31, 2024, this deadline has now passed.

How Parakar supports you

At Parakar, we ensure:

- Payroll system updates: All changes to ceilings, contribution rates, and new laws are integrated into your payroll systems.

- Compliance: Accurate processing of digital sick notes, child sick leave, and statutory contributions.

- Employee communication: Clear guidance on the impacts of these updates, including regional changes and adjustments to net salaries.

- Custom support: Tailored advice for handling specific scenarios, such as statutory vs. private insurance transitions.

Parakar: Your partner for payroll and HR

At Parakar, we don’t just handle payroll, we’re your partner in business growth. In addition to payroll services, we offer:

- HR Consultancy: Need help with employment contracts, managing employee lifecycles, or labour law compliance? We’ve got you covered.

- Payroll Consultancy: Facing a payroll challenge or seeking to optimize operations? Let us provide the guidance you need.

- Employer of Record (EOR): Simplify international hiring without establishing local entities.

- Payroll & HR full service: Perfect for international businesses looking for seamless HR and payroll solutions without the burden of in-country HR teams or payroll software.

If you have questions about these updates or are ready to take advantage of our services, reach out to Parakar today. Together, we’ll ensure your payroll runs smoothly and your business thrives in 2025 and beyond.

Get in touch