What are the legislative changes for 2023 in Ireland?

At the start of the year, various laws and regulations in Ireland changed. We explain significant changes to the Irish employment law. As your in-country knowledge partner, we have sorted it out.

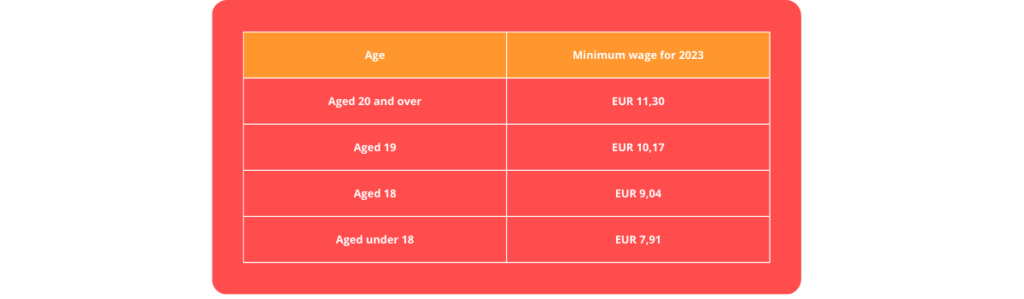

Minimum Wage

As of January 1, 2023, the minimum wage in Ireland has increased to EUR 11.20 per hour. This is an increase of 2.2% from the previous year. The increase in the minimum wage is in line with the government’s commitment to increasing the standard of living for low-paid workers. The increase is also intended to help combat inflation and the rising cost of living. This will be reviewed annually.

Sick Leave Act

Since 1 January 2023, you have a right to 3 days’ sick pay a year. This is called statutory sick pay (that means the legal minimum). Sick pay is paid by your employer at 70% of your normal pay up to a maximum of €110 a day.

Implementation phases

The government’s statutory sick pay scheme will be phased in over a four-year period to help employers, particularly small businesses, to plan ahead and manage the additional cost, which has been capped.

2023 – 3 days sick pay

2024 – 5 days sick pay

2025 – 7 days sick pay

2026 – 10 days sick pay

What is the rate of Statutory Sick Pay?

Employers are required to pay sick pay at a rate of 70% of an employee’s wage, with a daily limit of €110. This daily limit is calculated based on the 2019 average weekly earnings of €786.33, which equates to an annual salary of €40,889.16. This limit may be adjusted in the future to account for inflation and changes in income, as determined by ministerial order.

Who will be entitled to Statutory Sick Pay?

All employees including fixed-term or part-time employees will be entitled to the benefits outlined in the Statutory Sick Pay Scheme, however they will have to obtain a medical certificate to avail of statutory sick pay, and the entitlement is subject to the employee having worked for their employer for a minimum of 13 weeks.

Once the entitlement to statutory sick pay from the employer ends, employees who need to take more time off may qualify for illness benefit from the Department of Social Protection subject to PRSI contributions.

How can we help you?

Are you interested in learning more about employment in Ireland? Our local HR experts would be happy to assist you!