Payroll and Social Security Updates in the Netherlands for 2025

As we prepare for 2025, significant updates to payroll, social security premiums, and tax regulations in the Netherlands are set to take effect. At Parakar, we are committed to ensuring that your payroll systems are fully updated and compliant with these changes. Below, we’ve outlined the key updates to help you stay informed about what to expect in the coming year.

Payroll changes for 2025

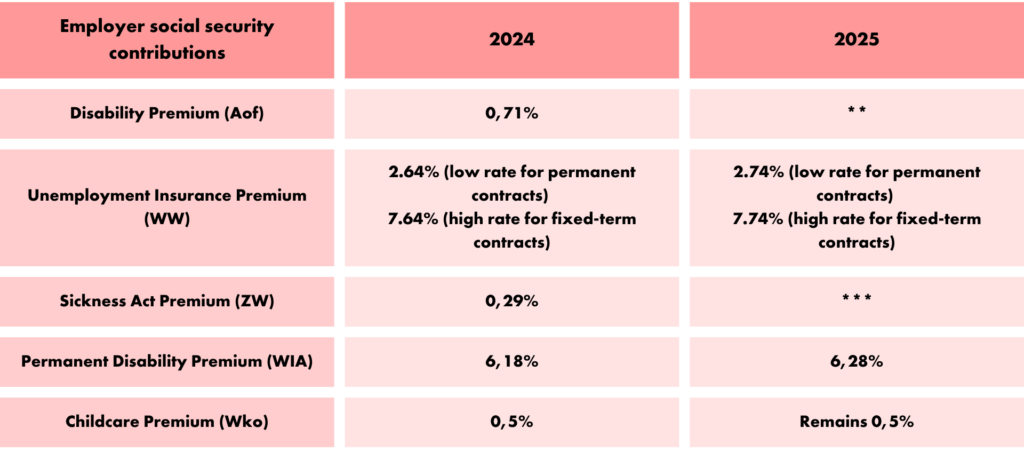

Employer social security contributions

The employer contribution rates for social security in 2025 are as follows.

** Employers will receive an official notification with the applicable rate, and Parakar will ensure this is correctly applied to your payroll.

*** Employers will receive the applicable rate in their annual notification, which Parakar will integrate into the payroll system.

Contribution ceiling

Employee contributions for social security in 2025 remain unchanged:

- General Old Age Pensions Act (AOW): 17.9%

- National Survivor Benefits Act (ANW): 0.1%

Parakar will manage the accurate calculation and deduction of these contributions.

Other payroll updates for 2025

- Income tax adjustments

- First income tax bracket rate: Reduced from 36.97% to 35.82% for incomes up to €36,393.

- General tax credit: Decreased from €3,362 to €3,068. However, the threshold for phasing out the credit will increase from €24,812 to €28,406, benefiting mid-level earners.

- Minimum wage increase: The minimum hourly wage will rise to €14.06 (2.75% increase). Parakar will ensure this is reflected for any employees earning minimum wage.

- Home office allowance: The tax-free home office allowance will increase to €2.40 per day. Parakar can help implement this allowance for your employees.

- Abolition of low-income benefit (LIV): The LIV benefit for low-income employees will be discontinued from 2025. Parakar will ensure this is accounted for in payroll processing.

- 30% Ruling adjustment: The tax-free reimbursement under the 30% ruling remains unchanged for 2025 but is scheduled to reduce to 27% by 2027.

- Enforcement of false self-employment: From January 1, 2025, the Dutch Tax Authority will strictly enforce regulations against false self-employment. Parakar is available to assist in reviewing employment classifications to ensure compliance.

How Parakar supports you

At Parakar, we understand that legislative changes can be complex. That’s why we take responsibility for

- Updating payroll systems. We will integrate all 2025 updates into your payroll systems, including new tax brackets, contribution rates, and wage thresholds.

- Ensuring compliance. Our team actively monitors Dutch labour and tax law changes to keep your business aligned with local regulations.

- Employee communication. We can provide clear and accurate communication to your employees regarding changes affecting their pay.

- Custom solutions. Whether it’s implementing home office allowances or managing complex tax credits, Parakar is here to tailor solutions to your needs.

Grow with Parakar

At Parakar, we don’t just provide payroll solutions, we are your partner in business growth. In addition to payroll management, we offer the following support.

- HR Consultancy: From employee relations to organizational development, we provide expert advice to help you build a strong, compliant, and engaged workforce. Think of employee contracts updates, support with managing employees lifecycles and more.

- Payroll Consultancy: Gain insights into optimizing your payroll operations, compliance strategies, and cost-saving opportunities.

- Employer of Record (EOR): Expand your business internationally without the need for local entities. We manage employment and compliance so you can focus on growth.

- Payroll & HR full service: Need a well-managed HR and Payroll support for your team in our core countries across the UK and Europe? This may just be the service you are looking for. Perfect for international or growing business what don’t want the bother of having in country HR teams, Payroll Licenses and Software, as well as the competence to manage them.

Why stop at payroll? Let us help you streamline your HR and payroll operations while unlocking opportunities for growth, need any benefits contracts, immigration support, and more, there’s so much more at Parakar.

If you’re ready to take advantage of our services or have questions about these updates, reach out to your Parakar representative today. Together, we’ll ensure your payroll runs smoothly and your business thrives in 2025 and beyond.

Get in touch