Payslip in the Netherlands: How does it work?

Reading a Dutch payslip for the first time? You probably wonder why Dutch people have to use such complicated wordings! Although payslips in the Netherlands may differ in structure, they usually contain the same elements. Parakar explains how to read a Dutch payslip, or in other words: Dutch payslip explained.

Dutch employers are obliged to issue a payslip to employees for every change in the amount to be paid, which means that you must receive a payslip at least once a year. With variable wages, a payslip must be provided per period. Many collective labour agreements state that a payslip is given with every wage payment.

Abbreviations on your payslip

ZWV, WIA, WW, SV: The many abbreviations for Dutch acts regarding social insurances on a payslip can get you easily confused. Let’s start by explaining the employers’ statutory contributions to these acts that often appear on a payslip. This will make it a lot easier to understand.

- ZWV = Health Insurance Act (also known as loon ZVW or wage ZVW)

- WW = Unemployment Insurance Act

- WIA = Incapacity for Work Act

- ZW = Sickness Act

- ANW = Surviving Dependants Act

- AOW = General Old Age Pensions Act

To keep things simple, we have divided the Dutch payslip into three parts. We’ll talk you through which information you can find in every part.

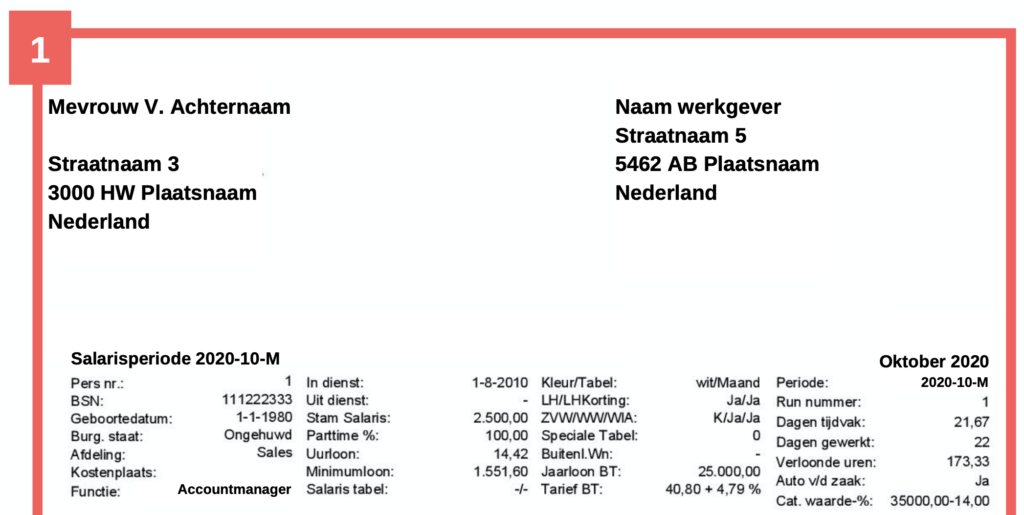

1. Top of the Dutch payslip

The payslip starts with some basic information. You can find the name and address of the employee on the left and name and address of the employer on the right. The following part contains more data about the employee. Apart from the date of birth, job function, and the date on which the employment started, this table contains the following information:

The top part of your payslip contains the basic information about you and your employer. Besides your name, address, and job function, you’ll also find:

- BSN: Citizen Service Number

- Pers. Nr: Employee number within the company

- Burg. Staat: Marital status

- Uurloon: Hourly wage

- Minimum loon: The legal minimum wage applicable for the employe

You’ll also see these elements:

- Kleur/Tabel: Indicates which tax table is applied. ‘Wit’ means wages from current employment. This relates to the loonheffing tabel — but what’s the loonheffing tabel meaning? It refers to the tax rate table the employer uses to withhold the right amount of taxes from your salary.

- LH/LHKorting (Payroll Tax Credit): LH stands for loonheffing. Wondering what is LH in payslip or lh meaning in payslip? It’s short for “loonheffing” – the combined wage tax and national insurance contribution withheld from your salary.

- Loonheffing BT / Jaarloon BT: The year wage BT or loonheffing BT is used to calculate tax on special payments like bonuses. The jaarloon BT is your estimated annual taxable wage for tax purposes.

- What is loonheffing? It’s the tax and national insurance contribution deducted from your salary by your employer. Or, in short: loonheffing meaning = wage tax + social security.

- What is loonheffing in English? It literally translates to “wage tax”.

2. Middle part of the Dutch payslip

The middle part of the payslip shows exactly how the net salary is calculated. The amounts in the column Inhouding show whether a certain wage component is part of the salary on which the employee pays payroll taxes, and in the column SVW you can see which part the employer has to pay in terms of employee insurance contributions.

- This part shows how your gross salary is transformed into your net salary. You’ll find key components such as:

- Bruto: Your gross salary, including extras like company car value or pension deductions.

- Werknemer Verzekering (Employee insurance): Employers pay contributions on your behalf. The amount may vary depending on your situation.

- Loonheffing (payroll tax): As mentioned before, loonheffing meaning is the combination of wage tax and national insurance contributions. This is where employment credit op loonstrook (employed person’s tax credit) also comes into play, this credit lowers the amount of tax you pay.

- Declaratie onkosten: Variable expenses paid out to the employee.

- Totalen: Your total net salary.

3. Bottom of the Dutch payslip

- Reservering: Saved amounts such as holiday allowance

- Vakantiegeld: Holiday pay reserve, typically paid in May or June

- Fiscaal loon: This is the wage used to calculate your income tax. It includes your gross salary and your ZVW contribution reimbursement.

- SV/ZVW/WW/WAO Loon: These are wages used for calculating social contributions like unemployment and disability insurance. Again, the wage ZVW meaning shows how your contribution to health insurance is calculated.

- Arbeidskorting: This is the employment credit op loonstrook again, it’s a discount on your payroll tax and one of the biggest contributors to the difference between gross and net salary.

How can we help you?

Do you need help reading or drafting a payslip? Or are you looking for payroll solutions in The Netherlands? Our HR experts in the Netherlands are happy to support you. Contact us and we will get in touch with you as soon as possible!