What are the legislative changes for 2023 in Belgium?

As the new year approaches, we wanted to take a closer look at the legislative changes that are set to take effect in 2023. These changes will impact the world of employment in Belgium, and it’s important to be aware of them in order to ensure compliance. In this blog, we provide a summary of the key changes in employment law in Belgium for 2023.

Belgium is divided into the different regions of Flanders, Brussels and Wallonia. Regulations can differ per region.

Immigration costs

Immigration service costs EUR 3000 which involves the complete application for the Single Permit and EU Blue Card:

- Overview of specific documents to be obtained;

- Temporary Social Security Number application to perform the hiring declaration;

- Preparation of employment agreement;

- Preparation of healthcare regulation;

- Preparation of application;

- Submission of application;

- Follow-up procedure;

- Contact with the Belgian embassy in the country of origin for Visum D

This does not include:

- The Single Permit fees (Immigration costs to authorities) – Fees range from 0 to 363 euros. This charge depends on the situation.

- The Shipping cost

- The translations fees

Belgium is divided into the different regions of Flanders, Brussels and Wallonia. Regulations can differ per region.

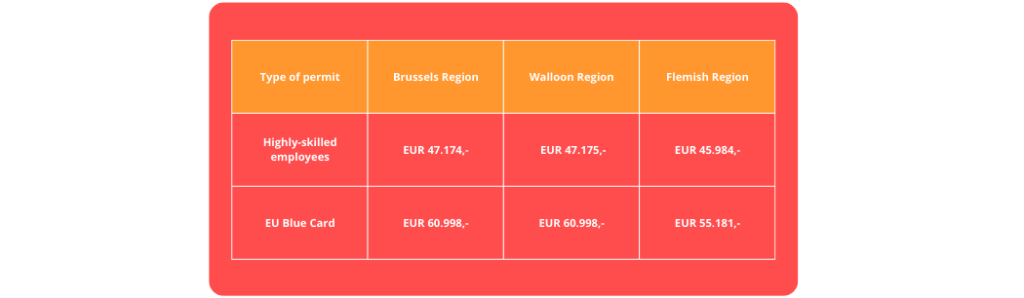

Minimum wages Belgium for obtaining a work permit in 2023

Minimum wage Belgium in 2023

In Belgium, the minimum wage is set by the government and is reviewed annually.

* For employees with a local Belgian contract working in the Flemish Region and under 30 years of age, the amount is €36,787.20. The higher amount needs to be met as soon as the employee turns 30.

** Will be confirmed by Decree

Withholding taxes

The method of calculating the 2023 withholding tax has changed. The calculation consists of 4 steps.

These four steps are :

A. determining gross annual income;

B. converting gross annual income into taxable net annual income;

C. calculate the annual tax;

D. calculate the withholding tax.

Below you can find a numerical example of an unmarried employee without children:

How can we help you?

Our experts in Belgium are happy to support you and advise you with all requests regarding employing in Belgium.