Labour Law and Tax Regulations Updates in Spain for 2025

Spain is gearing up for significant shifts in its labour law and tax regulations by 2025, with several transformative changes on the horizon. These updates aim to modernize workplace practices, enhance work-life balance, and align with European standards. From the highly anticipated reduction in working hours to increases in minimum wages and paternity leave, these changes promise to reshape the employment landscape for workers and employers alike.

In this blog, we’ll explore the key changes expected regarding Spanish labour laws that take effect in 2025, including labour law reforms such as the digitalization of time recording and adjustments in dismissal compensation. Whether you’re an employer preparing for compliance or an employee curious about how these reforms will affect you, this guide will provide a comprehensive overview of the upcoming regulations.

Reduction of working hours in Spain 2025

Pending approval, one of the most eagerly awaited changes is the reduction of the maximum working week from 40 to 37.5 hours per week. This measure aims to promote a more flexible and conciliatory working day and would begin to be applied on 1 January 2025. This reduction will not affect salaries, so the employer’s obligations will remain the same.

Many collective agreements in Spain already regulate a maximum working week of 37.5 hours, which translates into an intensive working week on Fridays and in summer.

Digital registration and time control

This is one of the major regulations that go hand in hand with the reduction of working hours in Spain in 2025. The new law on time recording will become a reality in 2025. Only digital time recording will be valid. To ensure compliance with the reduction of working hours, this digitalization will allow the Inspectorate to access the register telemetrically and at any time. It is necessary to have a time and attendance software or app that meets the requirements for workers’ time registration.

Digital disconnection

Another of these regulations related to the reduction of working hours in Spain is the guarantee of digital disconnection. It is understood that the new digital time control will make this more controlled.

Increase in the minimum wage (SMI)

The government wants to raise the minimum salary again in 2025. This increase would be 5% and would represent 60% of the average wage in the country. This would translate into a rise of approximately 56 euros to reach €1.190 per month. €1.388,33 per month in the case of 12 annual payments.

Compensation for unfair dismissal

The measure responds to the decision of the European Committee of Social Rights (ECSR). It ruled that Spain is in breach of article 24 of the European Social Charter, which guarantees adequate compensation for workers in the event of unjustified dismissal. The approach could take the form of an increase in compensation from 2025.

Extension of parental leave

By 2025, the government also plans to extend paternity leave, a measure that aims to strengthen family life. Currently, both maternity and paternity leave in Spain is 16 weeks, but the proposal is to increase this to 20 weeks.

Employers’ social security contributions

For the year 2024 the maximum contribution base is €4.720,50, i.e. for annual salaries of €57.000 or more, and the fixed monthly social security contribution is €1.535,58.

By 2025, the maximum contribution base could be revalued by 4 % and/or 4.2 % to €58.911,84 and/or €59.025 (for annual salaries equal to or above that bracket). Considering the possible revaluation, the new maximum contribution bases could be €4.909,32 and/or €4.918,75, with the fixed monthly contribution amounting to €1.593,13 and/or €1.596,01.

*The new base will be published in January 2025.

Solidarity quota

The solidarity quota or additional solidarity contribution is an extra contribution to be paid by certain workers above certain salary ranges. It is regulated by Royal Decree 322/2024. The solidarity contribution 2025 only affects workers who exceed the maximum contribution base.

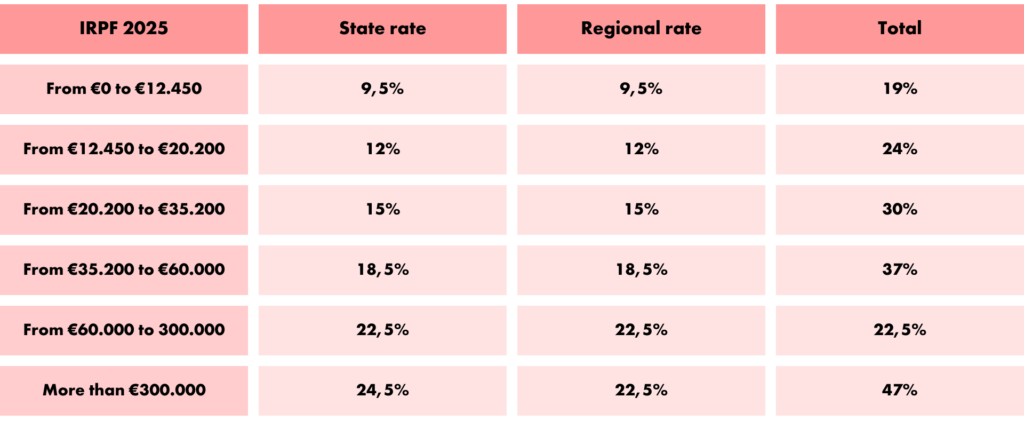

Personal income tax (IRPF 2025)

With the new year, this is how the personal income tax brackets for 2025 will look:

Preparing for change in 2025

The labor and tax reforms expected in Spain by 2025 represent a significant shift towards a more modern, equitable, and employee-friendly work environment. From shorter working hours and enhanced digital controls to increases in the minimum wage and extended parental leave, these changes are set to impact employers and employees alike. Understanding and preparing for the new labour laws in Spain is essential to ensure compliance and take advantage of the opportunities they bring.

Now is the time to act. Employers should begin reviewing their internal policies, updating payroll systems, and investing in compliant digital tools for time tracking. Employees, too, can start exploring how these reforms will enhance their work-life balance and financial well-being.

Stay ahead of the curve and ensure a seamless transition into 2025 by consulting with HR and compliance experts. Don’t wait, start planning now to navigate these changes with confidence. Reach out to our team today to learn how we can help you prepare for Spain’s evolving labor and tax landscape.